What Does Your Budget Look Like? A Guide to Crafting the Perfect Financial Plan

Achieving your goals and properly handling your money depend on you setting a budget. A customized budget offers the road map to success whether your savings are for a trip, debt is being paid off, or retirement is being planned. This guide “what does your budget look like” will enable you to overcome obstacles, investigate budgeting methods, and create a custom budget fit for your situation.

Understanding the Importance of a Personalized Budget

Why Your Budget Should Reflect Your Financial Goals

A budget is a representation of your priorities rather than only a financial tool. Whether your objectives call for saving for a down payment, creating an emergency fund, or debt elimination, your budget should complement them. A customized budget guarantees that every dollar you save or spend advances you toward your goals.

The Benefits of Customizing Your Budget

Customized budgets fit your way of life and simplify following. It helps you prevent needless spending, properly distribute resources, and concentrate on the really important aspects. Customizing your budget also emphasizes places where you may maximize spending and boost savings.

Common Mistakes in Budgeting and How to Avoid Them

Many people make mistakes when budgeting, such as being overly rigid or forgetting to account for fluctuating expenses. Avoid these errors by setting realistic spending limits, constantly monitoring your budget, and having a buffer for unexpected charges. Consistency and adaptability are important to good budgeting.

Key Components of a Well-Balanced Budget

Fixed Expenses: Managing Rent, Utilities, and Insurance

Rent, utilities, and insurance are among fixed expenses—nonnegotiable. These expenses are constant every month hence they should be given top priority. To keep your financial stability, make sure these necessary payments do not surpass half of your salary.

Variable Costs: Planning for Groceries, Transportation, and Entertainment

Variations in cost depend on lifestyle and use. Examples are dining out, gas, and groceries. Track these outlays diligently to prevent overspending. Establishing a monthly limit for discretionary spending guarantees that you keep within your means.

Savings and Investments: Building a Financial Safety Net

Long-term security calls for savings and investments. Set aside at least twenty percent of your pay for these categories. Start with an emergency fund covering three to six months of needs, then concentrate on retirement accounts or other investment options.

Steps to Create a Budget That Works for You

1. Assessing Your Income and Cash Flow

Budgeting starts with knowledge of your income. List all your sources—including side projects, freelance employment, and pay. If your income swings, figure an average based on the prior six months to make a reasonable projection.

2. Tracking Expenses to Identify Spending Habits

Track your spending for at least one month to see trends. Log purchases and classify them in notebooks or applications. Understanding where your money goes helps you decide how best to cut pointless expenses.

3. Categorizing Needs, Wants, and Future Goals

Sort your spending into three categories: needs, wants, and future projects. covers needs like food and shelter. Among wants are non-essentials include entertainment. Future plans call for investments and savings. Giving money to everyone guarantees a harmonic approach.

Popular Budgeting Methods to Explore

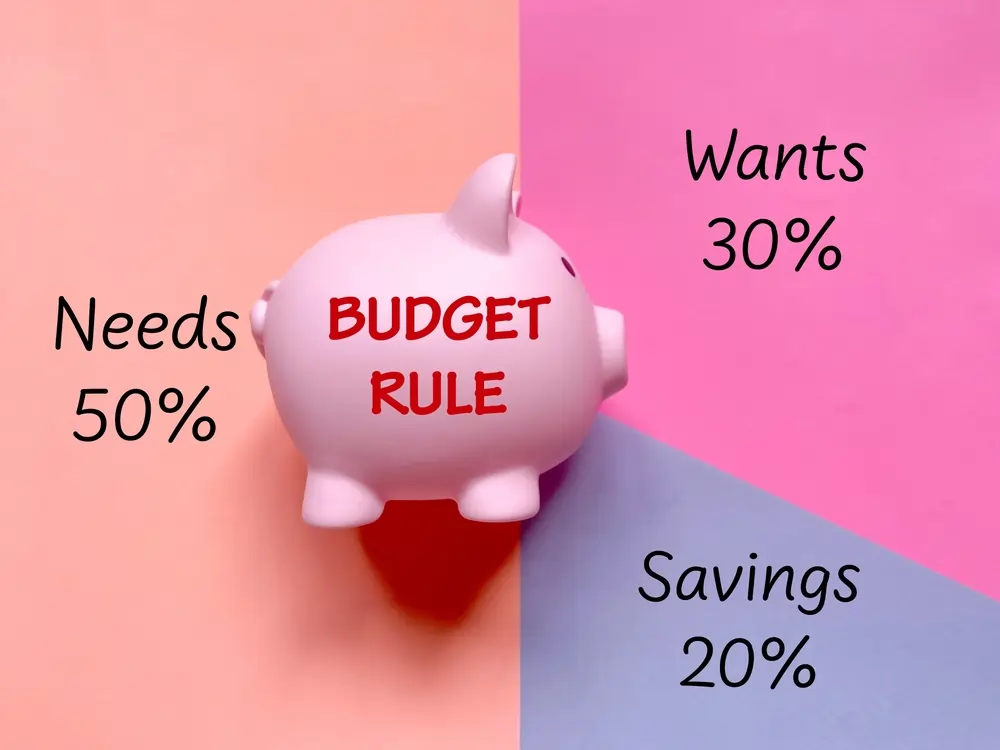

The 50/30/20 Rule for Simplicity and Balance

This approach divides your income 50% for needs, 30% for wants, and 20% for debt payback or savings. For keeping balance and handling financial priorities, it’s basic but powerful.

Zero-Based Budgeting for Detailed Financial Control

Every dollar in zero-based budgeting serves a specific use. Zero follows from total income less costs. Those wanting total financial control will find this approach perfect.

Envelope System for Cash Management

The envelope system controls expenses with cash. Set aside money for each category— food or entertainment—into envelopes marked for each. Spending for that category ceases when an envelope is empty, therefore guaranteeing discipline.

Tools and Resources to Simplify Budgeting

Best Budgeting Apps for Tracking Finances

Budgeting is simplified with apps as Mint, YNAB (You Need a Budget), and PocketGuard. They track spending patterns, give alarms, and document costs. Use them to remain orderly and to make simple changes.

Using Spreadsheets for a Tailored Approach

Spreadsheets give freedom for personalizing budgeting. Sort revenue and spending using Excel’s or Google Sheets’ templates. Add automatic computation formulas to streamline tracking.

Online Budget Calculators for Quick Estimates

Online calculators offer a rapid means of income and expenditure based budget estimation. Websites like NerdWallet provide free tools meant to enable effective planning.

Tips for Staying Consistent with Your Budget

Reviewing Your Budget Monthly

Maintaining a budget calls on consistency. Review it once a month to make sure it captures your financial condition. Change categories as necessary to fit changing lifestyle choices or unanticipated costs.

Adjusting for Lifestyle or Income Changes

Your finances are affected by life events as a new job or city relocation. Update your budget often to fit these developments so that it stays pertinent and efficient.

Avoiding Overspending with Better Planning

Make deliberate purchases to prevent unneeded expenditure. Make lists of your necessities above your wants. Spending 24 hours before non-essential purchases forces you to consider carefully.

How to Optimize Your Budget for Savings

Reducing Unnecessary Expenses

Cut out costs that have little bearing on your life. Cancel unneeded memberships, start cooking at home rather than out-of-pocket dining, and change to energy-efficient appliances. Little improvements add up to big savings.

Setting Realistic Savings Goals

Based on your income and spending, create reasonable savings plans. Start modest—say $50 a month—then progressively raise when your financial circumstances becomes better. Well defined goals inspire you to be disciplined.

Automating Savings for Consistency

For consistency, automatically send money to a savings account. Most banks let you plan regular deposits, so simplifying and methodically saving becomes easy.

Overcoming Budgeting Challenges

Managing Irregular Income Effectively

For independent contractors or commission-based employees, erratic revenue can make budgeting difficult. Plan based on lowest predicted income, then save extra money in high-income months to offset lean times.

Preparing for Unexpected Expenses

Unexpected costs that throw off your budget could be medical bills or auto maintenance. Create an emergency fund to cover these expenses without straying from financial path.

Staying Motivated to Stick to Your Plan

While motivation declines with time, monitoring development keeps you oriented. To keep motivated, celebrate achievements including completing a financial goal. Review your goals often to help you remember why budgeting is important.

Real-Life Budget Success Stories

How Budgeting Transformed Financial Lives

Practical illustrations of the value of budgeting show Following a zero-based budget and eliminating discretionary expenditures, one family dropped $20,000 in debt over two years.

Lessons from Individuals Who Mastered Their Finances

Good budgeters stress the need of tracking costs, giving savings first priority, and being consistent. For others, their experiences provide both inspiration and pragmatic advice.

Simple Habits for Long-Term Budgeting Success

Little behaviors like weekly expense assessments or automated saves build a good basis for financial wellness. Over time, these behaviors provide ongoing success.

Conclusion

Making a budget means determining income, classifying expenses, and selecting a technique fit for your way of life. Its efficiency is guaranteed by consistency and frequent assessments. Although beginning a budget can seem overwhelming, little actions add up to a significant difference. Start monitoring your spending and create reasonable targets to help you to have financial control.

Budgeting is a road trip rather than a destination. Staying orderly and flexible can help you to reach financial stability and lead the life you want.

FAQs:

- What does a good budget look like? A healthy budget represents your financial priorities, balances income and expenses, and includes savings.

- What tools can help me create a budget? Excellent tools for building and monitoring budgets are online calculators, spreadsheets, and budgeting applications.

- How can I adjust my budget for irregular income? Base your budget on your lowest projected income; save extra for tight months.

- How do I stick to a budget long-term? Consistent tracking, reasonable goals, and frequent reviews help you keep on target.

- What is the best budgeting method for beginners? For individuals first learning budgeting, the 50/30/20 rule is straightforward and efficient.