Money Saving Advice: Proven Tips for Financial Success

Navigating the difficult terrain of today’s economy depends on savings. Growing living expenses call for careful planning and disciplined behavior based on financial security. Using sensible money saving advice guarantees stability, gets you ready for unanticipated circumstances, and opens the path for realizing your goals. This tutorial explores doable methods to improve your financial performance.

Understanding the Basics of Saving Money

What Does Saving Money Mean?

Saving money is putting aside some of your income for use in the future instead of devoting it all right now. This habit helps create reserves for long-term projects and crises. Unlike investing, saving emphasizes on maintaining money in easily available accounts such as cash reserves or savings accounts. Though they seek better returns, investments may include long-term obligations and risks.

Why Saving Money Advice is Essential

- Building Financial Security: Saving begins financial security. Strong savings plans guard against unanticipated costs such job loss or medical crises.

- Preparing for Emergencies and Future Goals: Savings create a safety net. They help you to meet unanticipated obstacles and pursue goals like house purchase, travel, or happily retired living.

Developing a Savings Mindset

Setting Financial Goals

- Importance of Goal-Setting for Motivation: Direction and inspiration come from financial goals. Savings can seem meaningless without goals. Clearly state your goals, such saving for education or creating an emergency fund.

- Examples of Short-Term and Long-Term Financial Goals: Short-term objectives could be credit card debt pay-off or vacation saving. Often long-term objectives center on property or retirement savings.

Identifying Spending Habits

- Recognizing Patterns That Hinder Saving: Track your spending to find behavior draining your money. Excessive dining out or impulse buying might ruin efforts at saving.

- Steps to Cultivate Mindful Spending: Learn to spend deliberately by separating wants from needs. For discretionary spending, use cash to help you control overspending.

Overcoming Barriers to Saving

- Common Challenges and How to Tackle Them: Low income, debt, or lack of budgeting skills can hinder saving. Tackle these barriers by prioritizing savings and seeking support, such as financial coaching.

- Staying Consistent and Motivated: Automating savings releases the work of hand transfers. Celebrate achievements to keep your excitement for your financial path.

Practical Money Saving Advice

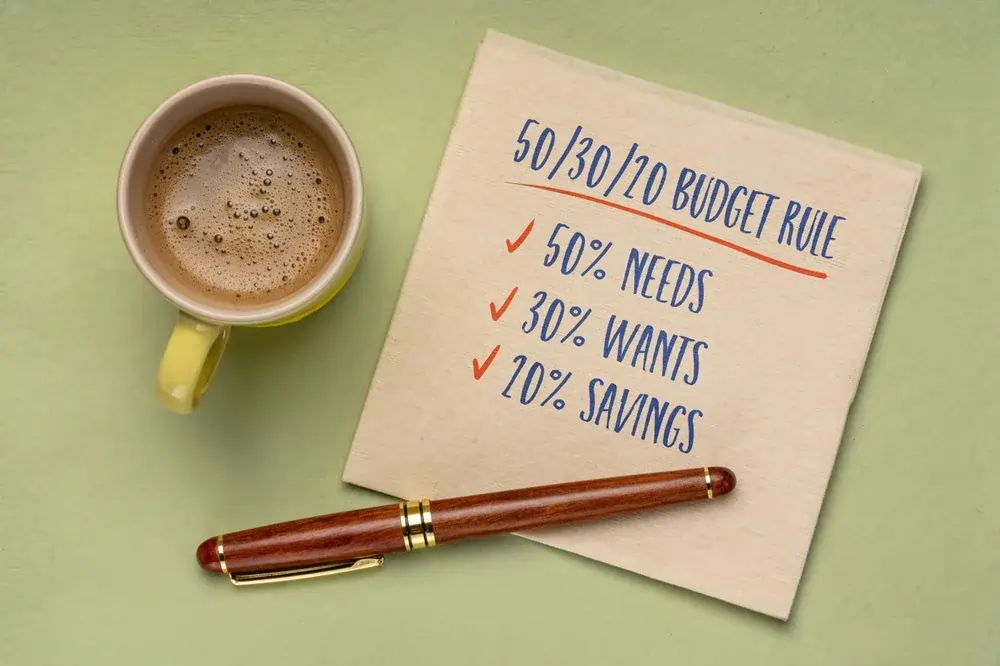

Budgeting Effectively

- How to Create and Stick to a Budget: Figure your monthly income and list your costs. Set aside money for needs, savings, and discretionary purchases. Review your budget often for accuracy.

- Tools and Apps for Easy Budgeting: Apps that ease budgeting include Mint and YNAB. These instruments examine financial trends, create warnings, and track spending.

Cutting Down on Expenses

- Simple Ways to Reduce Everyday Costs: Cook at home to cut expenses; cancel unwanted subscriptions; or negotiate bills. Little changes taken over time add up.

- Finding Alternatives to High-Cost Habits: Swap pricey interests for reasonably priced substitutes. Trade your gym memberships for outdoor pursuits or coffee runs for handcrafted beers.

Increasing Your Income

- Exploring Side Hustles or Additional Work: Side projects include freelancing, tutoring, or online sales of handcrafted goods help you increase revenue. Accelerate savings using these incomes.

- Leveraging Skills for Freelance Opportunities: From graphic design to writing, talented experts can provide services on sites like Upwork or Fiverr, earning extra money.

Automating Your Savings

- Benefits of Setting Up Automatic Transfers: By direct fund transfer to savings accounts, automation guarantees constant saving. This “pay yourself first” approach creates riches naturally.

- Recommended Tools for Automating Finances: Automated savings methods abound in banks and applications. Examples are Digit’s customized savings strategies or Chime’s automatic round-ups.

Smart Shopping Tips

Planning Purchases Ahead

- How to Create a Shopping List and Stick to It: A list reduces impulse buys. Following your list can help you to minimize accidental expenditure and organize your shopping visits.

- Avoiding Impulse Buying: Use a 24-hour rule to guide delayed purchases. This allows you time to assess whether a good is absolutely necessary.

Using Discounts and Coupons

- Finding the Best Deals Online and Offline: Look for sales on sites like Honey or RetailMeNot. Join reward programs for unique cashback and discounts.

- How to Maximize Loyalty Programs and Cashback Offers: To save money, sign up for loyalty programs at often visited establishments and use credit cards with cashback rewards.

Timing Your Purchases

- Best Times of the Year to Buy Certain Items: Seasonal sales—Black Friday and end-of-season clearances—offer notable savings. Plan major purchases for these times.

- How Seasonal Sales Can Save Money: Load up on basics during deals. For example, purchase winter clothing during spring or summer during fall sales.

Money Saving Advice on Major Life Expenses

Housing Costs

- Renting vs. Buying: Which is More Cost-Effective? Think over your lifestyle and financial circumstances. Renting gives freedom; buying generates equity over time.

- Tips for Saving on Utilities and Maintenance: Using energy-efficient appliances, closing drafts, and upgrading to LED lighting will help to lower utility expenditures.

Transportation

- How to Reduce Commuting Costs: Public transit, biking, and carpooling cut travel costs. If you must drive, choose fuel-efficient models.

- Benefits of Carpooling, Public Transport, and Fuel Efficiency: Fuel-efficient vehicles save gas prices; public transit saves on vehicle maintenance; and carpooling lowers fuel costs.

Healthcare

- Strategies to Minimize Medical Expenses: Preventive care helps to lower expensive treatment costs. Use GoodRx and compare insurance plans yearly to shop for reasonably priced medicines.

- Using Insurance Plans and Preventive Care Effectively: Knowing your insurance coverage will help you to prevent out-of-pocket expenses. Plan frequent visits to sustainably affordably good health.

Investing in Your Financial Future

Building an Emergency Fund

- Importance of Having a Financial Safety Net: An emergency reserve helps to avoid financial stress in unplanned circumstances. Try to save three to six months’ worth of household bills.

- How Much to Save for Emergencies: Create incremental targets and figure monthly expenses. Start modest and increase over time to help to lower overwhelm.

Saving for Retirement

- Why It’s Never Too Early to Start: Compound interest lets early saves grow. Start with modest contributions then raise them as income rises.

- Exploring 401(k)s, IRAs, and Other Retirement Accounts: Tax benefits abound from employer-sponsored 401(k)s and Individual Retirement Accounts (IRAs). Make regular contributions to enhance results.

Learning About Investments

- Basic Investment Options for Beginners: Start with low-risk choices include certificates of deposit (CDs) or index funds. Spread to balance gains and risks.

- How Saving Can Transition into Wealth-Building: Savings allow one to fund investments, therefore allowing money to increase gradually. Reinvest returns help to speed up wealth creation.

Real-Life Examples of Successful Savers

- Saving on a Tight Budget: By closely budgeting, cooking meals, and working a part-time job, a student saved twenty percent of their salary. These savings paid for a dream trip inside a year.

- Achieving a Dream Goal: A couple automating 25% of their paycheck into a separate account helped save for a house. Three years saw them reach their down payment target.

Common Mistakes to Avoid When Saving Money

Neglecting Small Savings Opportunities

- Why Small Savings Add Up Over Time: Each dollar saved helps toward long-term objectives. Skipping daily coffee purchases can save hundreds yearly.

- Examples of Overlooked Savings Chances: For significant savings, negotiate subscription prices, stay away from late payment penalties, and start using generic products.

Over-Restricting Your Budget

- Balancing Saving with Enjoying Life: Saving doesn’t imply sacrificing enjoyment. Set aside some for leisure to keep drive and satisfaction high.

- How to Create a Sustainable Savings Plan: Establish reasonable objectives and plan periodic treats. This guarantees that your scheme is sensible and durable.

Not Reviewing Savings Plans Regularly

- Importance of Reassessing and Adjusting Your Strategies: Quarterly review savings programs to match evolving conditions. Change donations to line up income increase.

- Signs It’s Time to Update Your Plan: Significant life events—such as a work shift or a new family member—indicate the requirement of modifying the budget.

Conclusion

Saving money requires discipline, planning, and adaptability. By following these proven strategies, you can build financial security and achieve your dreams. Consistency is key, and small steps lead to significant results. Start today and watch your financial future transform.

FAQs

- What are the easiest ways to start saving money? Track spending first, then minimize extraneous expenses and automate savings.

- How much of my income should I save? Though your target should be at least 20% of your income, change depending on your objectives and situation.

- Are there apps that can help me save money? Indeed, programs for budgeting and saving such as Mint, YNAB, and Acorns streamline things.

- How do I save money without drastically changing my lifestyle? Emphasize little adjustments like cutting utilities and resisting impulse buys.

- What’s the difference between saving and investing? While investing seeks long-term development with some risk, saving sets money for immediate need.